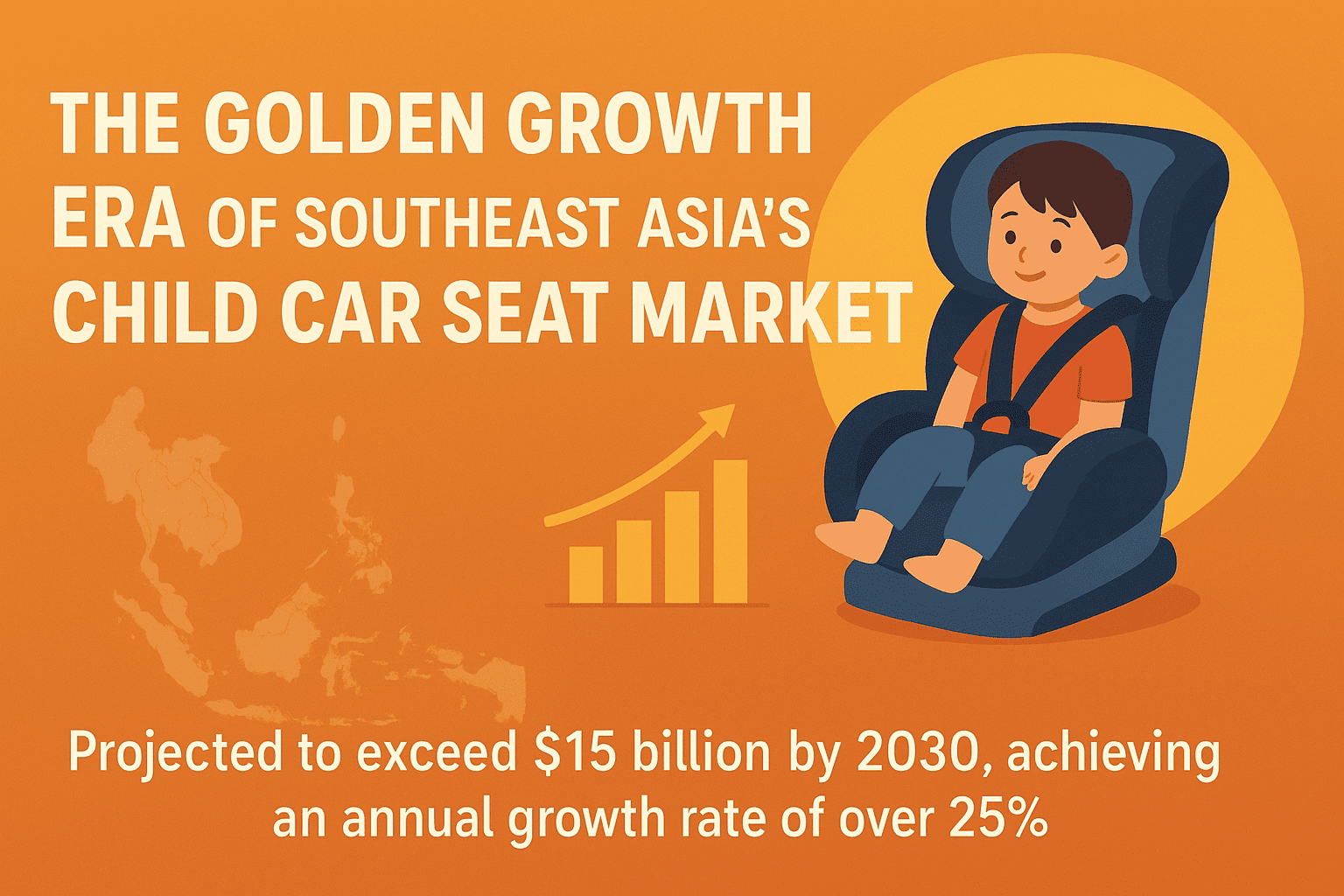

Introduction: The Golden Growth Era of Southeast Asia’s Child Car Seat Market

The Southeast Asia child car seat market is experiencing explosive growth, with regional market value reaching $5 billion in 2025 and projected to exceed $15 billion by 2030, achieving an annual growth rate of over 25%. This surge is driven by a triple engine: tightening regulations, evolving parenting philosophies, and rising purchasing power. For wholesalers and retailers, understanding market trends and precisely matching supply with demand is the key to capturing this expanding market. This article breaks down five core trends and provides actionable strategies to help industry players mitigate risks and seize opportunities.

Trend 1: Mandatory Policy Compliance – Certifications as Market Entry Threshold

Analysis

Southeast Asian countries are rapidly strengthening child passenger safety laws, making compliance a basic prerequisite for sales:

- Thailand: The revised Road Traffic Act (2022) mandates car seats for children under 6, with fines up to 2,000 THB. Import tariffs of 20% apply from 2024.

- Malaysia: Child car seats require SIRIM certification, complying with MS ISO 8124 series standards covering mechanical, physical, and chemical safety tests.

- Singapore: Products must meet international standards like EN 1273 and ISO 8124. The Consumer Protection (Safety Requirements) Office (CPSO) can impose fines up to SGD 10,000 or 2 years’ imprisonment for non-compliant goods.

Action Guide for Wholesalers & Retailers

- Prioritize sourcing products with target-market certifications (e.g., SIRIM for Malaysia, CPSO-recognized standards for Singapore). Avoid uncertified “no-name” products.

- Maintain a compliance database and track real-time policy updates (e.g., Thai tariff changes, certification renewals).

- Request complete test reports and certificates from suppliers to ensure clearance through customs inspections and market surveillance.

Trend 2: Premiumization Driven by Safety & Quality as Core Purchase Drivers

Analysis

A generational shift in parenting attitudes, led by Gen-Z parents, means price is no longer the primary concern:

- In Indonesia, 91% of parents check online reviews before buying, and 53% prioritize quality over just price.

- Consumers in Vietnam and Thailand prefer international brands (e.g., Britax, Graco), willing to pay a premium for higher safety standards and superior design.

- Demand is rising for organic, eco-friendly materials, with breathable fabrics and formaldehyde-free plastics becoming key selling points.

Action Guide for Wholesalers & Retailers

- Curate products emphasizing safety features: five-point harnesses, side-impact protection, and anti-pinch shields are non-negotiable.

- Introduce a mid-to-high-end product mix. Balance budget and premium lines (suggested 7:3 ratio) to cover different consumer segments.

- Market using certifications and test data (e.g., “Passes EN 71 flammability test”) to build consumer trust transparently.

Trend 3: Omnichannel Integration – Digital Transformation is Mainstream

Analysis

E-commerce penetration in Southeast Asia’s maternal and child sector continues to rise, necessitating a hybrid channel strategy:

- Indonesia’s online maternal & child trade share is projected to double from 2018 to 2025, with Shopee and Lazada as core platforms.

- Vietnam relies on offline chains like Bibo Mart and Kids Plaza, while Shopee is the primary online traffic driver.

- Trade fairs (e.g., Mother, Baby & Kids Indonesia) remain crucial for wholesalers to connect with retailers.

Action Guide for Wholesalers & Retailers

- Wholesalers: Join official distributor programs on major e-commerce platforms and participate in regional trade shows to expand offline dealer networks.

- Retailers: Enhance in-store experience (e.g., installation demos) and create online content (reviews, tutorial videos) for social media, where Indonesian mothers heavily seek parenting advice.

- Optimize logistics and after-sales: Partner with local logistics providers for multi-country delivery and offer installation support and warranty services.

Trend 4: Product Multifunctionality – Adapting to Multi-Scenario & Growth Needs

Analysis

Consumer demand is shifting from “single-use” to “full-lifecycle adaptability”:

- In space-constrained markets like Singapore and Malaysia, space-saving, foldable models are highly favored.

- Multi-stage products (e.g., adjustable seats for 0-4 years) are in demand to reduce replacement costs as children grow.

- Add-on features like removable canopies, storage pockets, and carry handles enhance convenience and appeal.

Action Guide for Wholesalers & Retailers

- Prioritize sourcing convertible, adjustable products (reclinable backrests, removable components) to cover more usage scenarios.

- In markets with larger families (e.g., Philippines, Indonesia), promote family bundle packages combining different seat sizes.

- Highlight “growth adaptability” and “space efficiency” in product descriptions to address key consumer pain points.

Trend 5: Supply Chain Localization Accelerates – Chinese Brands as Key Players

Analysis

The supply chain is evolving towards “localization + cost-effective imports”:

- Chinese brands (e.g., Goodbaby) are among the fastest-growing players in the region, leveraging geographic proximity and high adaptability, with products in over 90 countries.

- Local brands are emerging, but international brands still dominate the mid-to-high-end segment. Wholesalers must balance import and local sourcing.

- Supply chain optimization is critical, with automated production and cost efficiency becoming core supplier competencies.

Action Guide for Wholesalers & Retailers

- Wholesalers: Connect with quality Chinese suppliers (e.g., leading brands like Goodbaby) for cost-effective products, while monitoring promising local brands to diversify supply.

- Manage inventory turnover by stocking according to country-specific demand (e.g., affordable products for Thailand’s price-conscious single-mother demographic).

- Secure long-term supplier agreements to lock in pricing and stable supply, mitigating tariff and logistics cost fluctuations.

Conclusion: Leverage Trends to Win in Southeast Asia’s Growth Market

The core opportunity lies in building on compliance as the foundation, quality as the core, and omnichannel as the wings. Wholesalers and retailers must monitor regulatory changes, focus on safety and practical needs, and optimize channel and supply chain strategies. The goal isn’t to cover all categories, but to precisely match the regulatory requirements, purchasing power, and usage scenarios of your target market. By selecting the right certifications, products, and channels, businesses can establish a strong position and achieve sustainable growth in this golden market growing at over 25% annually.