Southeast Asia’s mother and baby market is booming, driven by rising birthrates and growing consumer spending. For entrepreneurs and procurement professionals, baby feeding products — such as bottles, bibs, and feeding sets — offer a strategic entry point into this fast-growing industry. Baby feeding items are essential daily products that every new parent needs, making them in constant demand. By offering the right mix of quality, safety, and affordability, new entrants can win trust and build brand awareness in the Southeast Asia baby market.

The Southeast Asia Baby Market: Growth and Opportunity

The baby care market in Southeast Asia is expanding rapidly. Millions of babies are born each year across countries like Indonesia, Vietnam, Thailand, and Malaysia. Higher disposable incomes and an increasing focus on child well-being mean parents are spending more on infant products than ever before. This growth shows up in numbers – the region’s mother and baby sector is now valued in the tens of billions of dollars and is expected to grow at a high single-digit or double-digit rate annually.

-

Large, Young Population: A significant share of Southeast Asia’s population is young and starting families. Countries like Vietnam and Indonesia report nearly a million newborns yearly. This creates a steady, predictable demand for baby goods, especially feeding items used from birth through the toddler years.

-

Offline Retail Dominance: Traditional offline retail channels remain a primary way parents buy baby products. For example, in Vietnam about 90% of baby product sales happen through brick-and-mortar stores (pharmacies, baby specialty shops like Concung and Kids Plaza, supermarkets, etc.), while online shopping accounts for a smaller share. Many parents still prefer to see and touch products before buying, especially items for infant care.

-

E-commerce Growth: While offline is big, e-commerce in Southeast Asia is booming too. Platforms like Shopee, Lazada, and TikTok Shop are popular for baby items, especially in urban areas. Online shopping offers convenience, promotions, and wide selection, attracting tech-savvy millennial parents. Successful brands often adopt an omnichannel approach, selling both through local distributors and online channels.

-

Evolving Preferences: Consumers are more health-conscious and well-informed than before. There is a clear trend toward BPA-free and chemical-free baby feeding products, organic baby foods, and eco-friendly diapers and wipes. Safety certifications and transparent materials are high priorities for parents. At the same time, many families are budget-conscious. They want affordable baby gear that still meets safety and quality standards. This price sensitivity means there is strong demand for both budget-friendly and mid-tier products. Brands that can innovate with low-cost, safe alternatives have an advantage.

-

Emerging Mid-Range Market: As the middle class grows, there is demand at all price tiers. Some parents opt for premium Western brands, but many others choose locally made or Asian brands offering good value. Surveys indicate that a large proportion of Southeast Asian parents (often over 50%) are willing to try new brands, especially if they offer features tailored to local needs. This creates opportunities for new products (like innovative feeding bottles or feeding sets) that blend quality with competitive pricing.

The upshot is clear: the Southeast Asia baby market is diverse and growing. Understanding this landscape is key for choosing which baby feeding products to introduce and how to reach customers.

Why Focus on Baby Feeding Products?

Choosing baby feeding products as an entry category can be smart for several reasons. Feeding accessories are everyday essentials from the newborn stage onward, giving retailers and distributors consistent sales opportunities. Here are key advantages:

-

Steady Demand: All parents must feed their babies, whether with breast milk or formula. Bottles, breast pumps, feeding spoons, and cups are recurring needs. Parents may buy multiple bottles of different sizes and various feeding tools as the baby grows. This creates a stable and repeated purchase cycle.

-

Wide Product Range: The feeding category covers many items, allowing a business to offer bundles or a range of products. For example, selling a set of BPA-free bottles along with sterilizers and feeding bowls can raise the average transaction value. It also builds brand loyalty: a satisfied mom with a brand of bottles is likely to buy the same brand’s cups or sippy cups.

-

Relatively Lower Regulatory Barriers: Compared to items like baby formula or medications, feeding accessories often face fewer regulatory hurdles (though safety standards still apply). It can be easier for a new entrant to import or locally manufacture bottle and spoon products than to register a food or drug product. This means faster time to market, though you still must meet safety certifications and labeling rules in each country.

-

Brand-Building with High Visibility: Feeding products (especially bottles, high chairs, and baby food makers) are highly visible items used daily. A strong product design or brand logo on these items can help spread brand awareness faster. Happy parents will often recommend practical feeding tools to friends and on social media.

-

Opportunity for Localization: The baby feeding category allows local customization. Products can feature seasonal packaging, local language instructions, or popular regional characters to appeal to Southeast Asian customers. Offering local flavors (for baby food makers) or bottle designs that match local eating habits can give an edge.

In summary, baby feeding products combine essential demand with flexibility, making them an ideal entry point for businesses venturing into the mother and baby industry in Southeast Asia.

Key Considerations When Selecting Baby Feeding Products

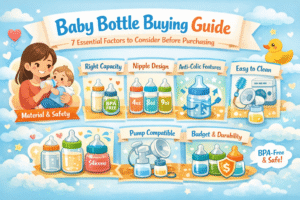

When choosing which feeding products to offer, consider these critical factors:

-

Safety and Materials: The top priority is always safety. Opt for products made from BPA-free, phthalate-free plastics, medical-grade silicone, or glass. Avoid materials that could leach chemicals. Check that products meet international safety standards (such as FDA, EU, or local regulatory approvals). In Southeast Asia, certifications like Vietnam’s QCVN, Malaysia’s SIRIM, Indonesia’s SNI, or Singapore’s Safety Mark can be important. Look for brands or factories that are transparent about material sourcing and testing.

-

Ergonomics and Design: Baby feeding tools must be practical for both baby and parent. Bottles should have easy-to-hold shapes, anti-slip grips, and anti-colic nipple designs. Spoons and forks need soft edges and appropriate size. Cups should be spill-proof for toddlers. Consider products that are simple to assemble, clean, and sterilize. Multi-functional designs (e.g. bottles that convert to cups, or bowls with suction bottoms) add value for busy parents.

-

Ease of Cleaning: Hygiene is vital. Products with simple, wide openings, dishwasher-safe parts, or sterilizer compatibility are highly valued. Avoid feeding gear with too many small parts that are hard to wash. Parents in humid climates especially appreciate designs that dry quickly and resist mold. Emphasize features like “one-piece nipple” or “bottle brush included” that make upkeep easy.

-

Quality and Durability: Even affordable baby gear should feel sturdy. Babies can be rough with their things, so durable materials and well-constructed seams/spouts are necessary to avoid leaks or breakage. Conduct quality checks for things like lid seals, strap fasteners, and the softness of silicone parts. Durable feeding products build trust – parents will come back to brands they feel confident won’t crack or cause injury.

-

Price and Value: Price sensitivity is high in many SEA markets. Compare cost vs. features. You may offer a premium BPA-free glass bottle, but also have a lower-cost plastic line to cover the budget segment. Consider bundling (e.g., a feeding set of bowl, spoon, and cup) to give value. Highlight cost-saving aspects (reusability, multi-use, long lifespan). Remember that local consumers often hunt for deals or promotions, so having tiered pricing or occasional bundles can attract cost-conscious buyers.

-

Regulatory Compliance: Ensure compliance with import laws and safety standards. Some countries require product registration, local agent representation, or specific labeling (in local language). Research local rules for baby products in each target country. Working with a local distributor or partner can help navigate these requirements smoothly.

-

Brand Reputation and Reviews: Even for lesser-known brands, pay attention to existing brand images. Well-known feeding brands (like Pigeon, Avent, Chicco) have strong recognition. If selling newer brands, emphasize their strengths (e.g. “Asian-designed,” “mother-tested,” or with pediatrician endorsements). Encourage customer reviews and ratings to build credibility. Brands that highlight health certifications or endorsements will stand out.

-

Cultural Preferences: Design and color choices can matter. In some cultures, bright colors or popular cartoon characters are preferred for baby bowls and plates. In others, simple pastel or neutral designs are the norm. Consider religious or cultural factors: for example, having a Halal certification on baby food makers can build trust in Malaysia or Indonesia. Also think about local cuisine (rice vs. cereal) – this can influence feeding gear (like porridge bowls with lids or rice feeders).

-

Packaging and Branding: Invest in attractive, informative packaging. In many SEA stores, products are displayed on shelves, so clear packaging with pictures and icons (e.g., “BPA-free,” “Dishwasher Safe”) catches the eye. Multilingual packaging (English plus local language) expands appeal. High-quality packaging (sturdy boxes, neat layout) gives a sense of premium value, even for affordable items. Remember: colorful, well-branded boxes often help online listings and in-store shelves alike.

By weighing these factors, you can narrow down to feeding products that meet safety expectations, fit local tastes, and stand out competitively.

Popular Baby Feeding Products to Offer

Within the baby feeding category, some items are essentials while others can add differentiation. Stock a range that covers newborn needs through toddler weaning:

-

Baby Bottles: The core of feeding gear. Offer bottles in different materials:

-

Plastic Bottles (Polypropylene or PPSU): Lightweight and affordable. Ensure they are BPA-free. These are good entry-level choices for budget-conscious buyers. Look for designs with vented or anti-colic nipples to prevent gas.

-

Silicone or Glass Bottles: Higher-end, eco-friendly options. Glass bottles are durable and chemical-free but heavier. Soft silicone bottles are unbreakable and safe if bitten. These appeal to health-conscious parents willing to pay a bit more.

-

Bottle Accessories: Extra nipples of different flow rates (slow, medium, fast) are must-haves. Parents often buy spares or replacements. Also stocking bottle brushes, cleaning kits, and nipple covers adds convenience and boosts sales.

-

-

Breastfeeding Support: Products that complement feeding by breast:

-

Breast Pumps: Manual or electric pumps help working moms or those with low supply. There is strong demand for reliable pumps (especially in urban centers). Closed-system electric pumps with quiet motors and digital controls are especially popular.

-

Breastmilk Storage: BPA-free plastic milk storage bags or glass storage containers. These go hand-in-hand with pumping. Labelled, stackable containers make it easier for moms to freeze and organize expressed milk.

-

Nursing Accessories: Items such as nursing pads (disposable or washable), nipple cream, and nursing covers can be bundled as kits or cross-promoted with other feeding gear.

-

-

Baby Feeding Sets: Utensils for when babies transition to solids (around 6+ months):

-

Spoons and Forks: Typically have soft, silicone tips and easy-grip handles. Sets often come in bright colors or themed designs.

-

Bowls, Plates, and Cups: Look for sets with suction bottoms or divided sections to make feeding less messy. Some sets include lids or suction-cup covers for leftovers. Fun themes (animals, characters) can help make mealtime enjoyable.

-

Weaning Cups: Spill-proof “sippy” cups or straw cups for older infants. These should be ergonomically designed and easy to clean. Training cups with removable handles or silicone straws are in high demand.

Feeding sets usually use plastic or food-grade silicone. Highlight features like “dishwasher safe” or “one-piece design” to appeal to busy parents.

-

-

Sterilization and Warming: Value-added accessories:

-

Bottle Sterilizers: Electric steam sterilizers or UV sanitizers. In many Asian households, a steam sterilizer is considered essential. Even simple microwave sterilizing bags are popular for their low cost.

-

Bottle Warmers: Electric warmers or insulated containers to heat milk. Useful for on-the-go or nighttime feedings. A bottle warmer that ensures the correct temperature can command a premium.

Offering one or two models of these devices complements bottle sales and positions your store as a one-stop feeding solutions provider.

-

-

Pacifiers and Teethers: Often sold in the feeding section.

-

Pacifiers (soothers) come in various shapes (orthodontic, round) and should be made of BPA-free silicone. Sell multi-packs since they are easy to lose.

-

Teething toys or rings, especially those designed to be chilled, help soothe infants. Offering teething-safe spoons or rings (chewable, food-grade silicone) can encourage older infants to self-feed.

-

-

Baby Food Makers: For markets where homemade baby food is popular, consider electric baby blenders or steam-and-blend cookers. These devices let parents steam fruits/veggies and puree in one unit. They are higher-priced items but appeal to urban, health-focused families.

-

Miscellaneous Feeding Tools: Round out your lineup with items like bottle holders or grips, nursing pillows (for bottle or breast feeding), silicone bibs, and snack cups. Also consider formula dispensers or powdered milk mixers for parents using formula regularly.

By covering both basic needs (bottles and nipples) and convenient accessories (sterilizers, pumping, feeding sets), a business can address every stage of infant feeding. This approach encourages customers to return as their babies grow through different feeding milestones.

Navigating Distribution and Retail Channels

Once you have chosen your products, the next step is getting them to customers. In Southeast Asia, both traditional retail and digital platforms are important:

-

Offline Retail (Brick-and-Mortar): Many parents still prefer to buy baby products in-store. Build relationships with:

-

Pharmacies and Drugstores: Chains like Watsons, Guardian, or local equivalents often have dedicated baby care sections. They stock trusted brands, and placing your feeding products here can reach a broad audience.

-

Supermarkets and Hypermarkets: Large stores (e.g. AEON, Big C, Lotte Mart, Giant) are convenient one-stop shops for families. They often carry feeding items near baby formula or personal care aisles. Eye-catching displays or end-cap promotions here can drive impulse buys from parents doing routine shopping.

-

Specialty Baby Stores: Local mom-and-baby boutiques (for example, Mothercare outlets or local chains) target parents specifically. These smaller stores often welcome new brands, especially those offering good margins or unique products. They provide a more personalized sales pitch to parents.

-

Mom and Baby Expos: Participating in baby expos or trade fairs (like Bangkok Baby & Kids Expo or local parenting fairs) helps introduce products to retailers and consumers. Live demos and promotions at these events can generate buzz and immediate sales.

-

-

Local Distributors: Partnering with an established local distributor can accelerate market entry. Distributors have existing networks of retailers, understand import regulations, and handle warehousing and logistics. They also provide insight into local pricing and marketing. In Malaysia, Indonesia, Vietnam and other SEA countries, some distributors specialize in baby products – collaborating with them often means faster shelf placement across multiple outlets.

-

Online Marketplaces: Don’t ignore e-commerce:

-

Regional Platforms: Shopee and Lazada dominate in much of SEA. Listing products here reaches tech-savvy urban shoppers. Ensure product pages have clear photos, detailed descriptions, and competitive pricing. Fast-moving items can benefit from flash sales or vouchers.

-

Vertical E-tailers: Some websites specialize in baby goods (for example, Love, Bonito’s parent brand? Or other local mother-baby stores online). These niche platforms attract parents specifically and can help build a reputation among target shoppers.

-

Social Commerce: Many new parents buy baby items through social media (Facebook Shops, Instagram, TikTok Shop). Influencer endorsements and live-stream selling are powerful. Building a social media presence with helpful parenting content can complement other channels.

-

-

Pricing and Promotions: In offline channels, retailers typically expect a healthy margin (e.g. 20–30%). Set wholesale and retail prices carefully to allow for discounts or bundle deals. Promotions like “buy 2 get 1 free pacifier” or gift-with-purchase (e.g. a free feeding spoon with a bottle purchase) can spur sales. Seasonal promotions around holidays (Chinese New Year, Hari Raya, Christmas, etc.) also boost visibility and traffic.

-

Customer Service and After-sales: Offer clear warranty or return policies, even for lower-cost items, to build trust. Good customer service (clear instructions, answering safety questions, quick replacements if needed) encourages word-of-mouth. For online sales, ensure smooth order fulfillment, multiple payment options (credit card, e-wallets, cash on delivery), and responsive support.

-

Baby Product Distribution Specifics: Distribution in SEA can be fragmented. Besides national chains, there are thousands of small neighborhood stores selling baby products. Some distributors specialize in reaching these small shops quickly. Setting up local fulfillment (warehouse or local delivery partners) can reduce lead times and shipping costs — a key advantage on e-commerce platforms (fast free shipping often wins customers).

In summary, a combined offline/online strategy is optimal: leverage trusted retail outlets for credibility and local reach, while also building an online presence for convenience and wider reach. Strong distribution networks and attractive pricing will make your feeding products accessible to parents across the region.

Baby Care Trends to Watch

Staying ahead in the mother and baby industry means tracking emerging baby care trends. As of 2025, several themes are shaping which feeding products will win:

-

Health and Safety First: Parents increasingly prioritize non-toxic, BPA-free, and hypoallergenic products. Expect continued demand for feeding items labeled as BPA-free, lead-free, or made from “food-grade” materials. Brands that highlight these safety credentials (e.g. “medical-grade silicone”) will resonate with health-conscious consumers.

-

Eco-Friendly and Sustainable: Environmental awareness is rising. Reusable feeding products (silicone bibs, glass bottles) and recyclable packaging attract buyers. Some companies even offer recycling or return programs for used bottle parts. Biodegradable or compostable formula dispensers and feeding wipes (if you expand into related categories) are also growing niches. Even in feeding, look for products emphasizing plant-based plastics or bamboo-fiber utensils.

-

Smart & Connected Devices: Technology is entering the nursery. Smart baby monitors and app-connected bottle warmers or feeders (which track temperature or feeding times) are emerging. These are niche but gaining interest among tech-savvy parents. Consider simple tech add-ons, like color-changing bottle indicators or LED displays on sterilisers, to catch the eye of digital-first families.

-

Personalization and Local Flavor: Customization is on-trend. Some brands allow engraving the baby’s name on bottles or offer accessories in regional character designs. Local mother and baby expos often highlight products with local art or bilingual labels. Catering to local tastes (for example, smaller bottle sizes popular in certain countries, or specialized feeding tools for regional foods like rice porridge) shows cultural understanding and builds goodwill.

-

Affordable Innovation: High-tech often means high price, but there is room for “smart at low cost” devices. For example, a simple color-changing milk thermometer or a collapsible silicone bottle can be both innovative and affordable. Low-cost, clever solutions (like foldable travel bottle sets or all-in-one feeding kits) are likely to do well. Value-oriented parents love products that solve problems without breaking the bank.

-

Influencer-Driven Purchases: Word-of-mouth and online reviews heavily influence buying. New parents often consult parenting blogs, social media groups, and influencers before purchasing. Collaborating with local mommy influencers or pediatricians to review your baby feeding products, or hosting social media giveaways, can accelerate awareness and trust.

-

Omnichannel Experience: The line between offline and online shopping is blurring. Parents might research feeding products online and then buy in-store (or vice versa). Ensure product information and pricing are consistent across channels. Using QR codes on packaging that link to demo videos or reviews can engage consumers. Retailers can also use tablets in-store to show additional product info or promotions.

-

Health-Conscious Nutrition: While more about food than feeding tools, related trends do influence feeding products. With the rise of fortified baby formulas and organic baby foods, parents may look for precise measuring scoops, formula mixers, or specialized feeding schedules. Offering items like formula dispensers or portion control bowls can tap into this trend, especially in markets like Singapore and Malaysia where parents focus on nutrition.

-

Community and Education: Brands that provide helpful content (like feeding guidelines, baby nutrition tips, or safe weaning practices) build lasting trust. Workshops or online seminars on infant feeding can position a business as an expert. This kind of community engagement keeps your brand in parents’ minds beyond the product itself.

By aligning your product selection and marketing with these trends, you can stay relevant. For example, launching a new BPA-free glass bottle series or promoting a “complete weaning starter kit” taps into parental concerns. Always listen to customer feedback and watch global innovations, as Southeast Asian parents often eagerly adopt useful new ideas.

Conclusion

The Southeast Asian mother and baby market presents a lucrative opportunity, and baby feeding products are an excellent category for newcomers to target. This vital segment — covering everything from bottles and breast pumps to feeding spoons and sterilizers — ensures steady demand and the chance to build trust with young families from day one.

To succeed, carefully select feeding products that meet local parents’ needs: prioritize BPA-free, safe materials, ergonomic design, and affordability. Understand the regional market by country — each has its own distribution channels and consumer preferences — and leverage both offline retail (pharmacies, supermarkets, baby stores) and online platforms to reach customers. Partnering with experienced local distributors can smooth logistics and compliance challenges.

Stay attuned to baby care trends like health-conscious materials, convenience-driven innovation, and digital marketing. By doing so, your feeding products will not only meet current demand but also anticipate what modern Southeast Asian parents want next. With a solid strategy on product selection, pricing, and distribution, launching into the mother and baby industry via baby feeding products can be a successful first step into this booming market.