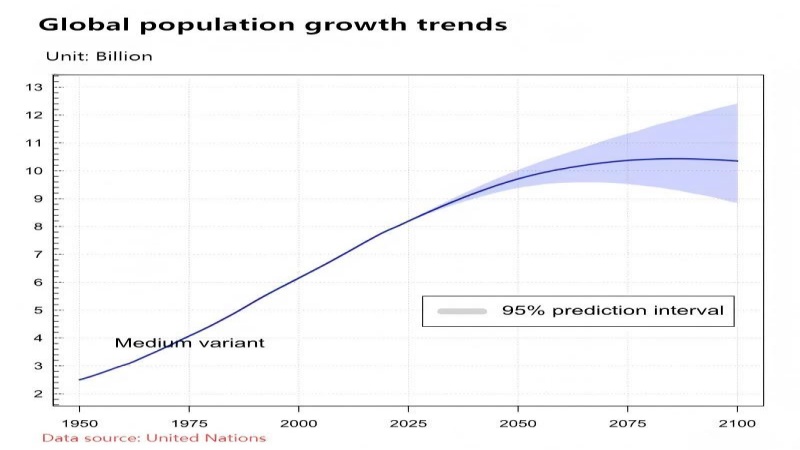

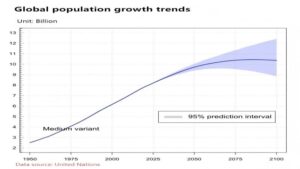

Data show that the birth population in major regions of the world is showing a continuous downward trend. The fertility rate in mature markets such as Europe and the United States is low, and the average annual birth rate in the European Union is less than 4 million. For example, the birth population in the European Union has dropped from a peak of 6.8 million in 1964 to about 3.67 million in 2023. China experienced a brief rebound after the adjustment of its fertility policy (reaching a high of 17.86 million in 2016), and then continued to decline: 15.23 million in 2018, 14.65 million in 2019, 10.62 million in 2021, and only 9.02 million in 2023; it increased slightly to 9.54 million in 2024. India’s birth rate remains high (about 23 million per year), which is the main driving force for global birth population growth. The annual birth rate in the United States remains low (about 3.66 million in 2022 and about 3.6 million in 2023), with an overall slight downward trend. The decline in birth rates in various regions has led to a slowdown in the demand for maternal and infant products: the slowdown in consumption and the adjustment of market structure have become the norm.

Infant milk powder market

- **Global scale and growth: **The global infant formula market size in 2024 is about US$81.72 billion, and it is expected to be nearly US$178.8 billion by 2032 (CAGR of about 10.15% from 2025 to 2032). Overall, the North American and European markets are large, and the Asian market is growing the fastest.

- **Product innovation: **In recent years, consumers have increased their demand for organic, pure and plant-based formulas. For example, in 2022, Danone launched a milk powder formula containing 60% plant protein to meet the demand for plant-based or flexitarian milk powder. Segmented innovations such as fortified nutrition, probiotics, and lactose-free are also emerging in an endless stream, and market competition focuses more on high-end and differentiated routes.

- **China market: **China is one of the world’s largest formula milk powder markets. The scale has grown from approximately RMB 160.5 billion in 2014 to RMB 342.7 billion in 2023, with an average annual compound growth rate of approximately 9%. The market share of domestic brands has increased significantly (40% in 2014 → 49% in 2019), and the proportion of domestic high-end formulas has also increased significantly. The main participants include local Yili, Feihe, Beingmate, etc., as well as multinational giants such as Nestlé, Danone, Mead Johnson, Abbott, and Wyeth. The overall competitive landscape presents a “duopoly” + multi-brand landscape. Consumers have high trust in imported and international brands, but domestic high-end brands are rising.

Diaper Market

- **Market size: **In 2019, the global baby diaper market size was approximately US$46 billion (accounting for nearly 45% of disposable sanitary products), with an average annual compound growth rate of approximately 5.1% from 2014 to 2019. According to industry reports, the global market size will be approximately US$47.58 billion in 2023, and is expected to grow to US$59.1 billion by 2028 (CAGR≈4.4% from 2023 to 2028). The Asia-Pacific region (especially China and India) has strong demand and is the fastest growing region; North America has the largest market size, followed by Western Europe.

- **Segment trends: **Pull-up pants (toddler pants) are growing rapidly, accounting for approximately 20% of the diaper market in 2019, with a compound growth rate of double digits in the past five years. At the same time, degradable and eco-friendly products are attracting attention. Major global manufacturers have launched bio-based and degradable diapers to meet consumers’ environmental protection demands.

- **Brand competition: **Major international brands include Pampers under Procter & Gamble and Huggies under Kimberly-Clark; Japan’s Unicharm (under its Moony and MamyPoko), South Korea’s Goodfeel, and L’Occitane also occupy part of the market. Chinese local brands such as Kao Merries (imported production) and the aforementioned domestic brands have a place in the market. In general, the diaper market is highly concentrated, and the leading brands dominate with their technology and channel advantages.

Children’s clothing market

- **Market size: **The global children’s clothing market size is about US$199.6 billion in 2022. China is the largest single market: China’s children’s clothing retail sales reached 1.4 trillion yuan in 2019 (about 1/3 of the world), and it is expected to increase to 256.2 billion yuan by 2022. With the increase in residents’ income and the liberalization of policies (relaxing the second and third births), the children’s clothing market is generally on an upward trend.

- **Consumption trends: **Parents in the new era pay more attention to the fashionability and quality of children’s clothing. The market demand for children’s clothing is no longer limited to functionality. Fast fashion and design have become competitive factors. The development of e-commerce channels has greatly changed the sales pattern: the proportion of online purchases continues to increase, and e-commerce and live streaming have become important channels. Offline channels are also sinking, and new community stores and brand collection stores are opening up the sinking market. The overall trend includes brand internationalization, intelligent production, personalized customization, sustainable development and online and offline integration. Domestic mainstream children’s clothing brands such as “Balabala” and “Anta Children” occupy an important market share by virtue of brand influence, but the market is still relatively fragmented, and European and American brands (such as Carter’s, Next, and Zara Kids) also have certain competitiveness.

Baby and child toy market

- **Educational toys: **The global educational toy market size will be approximately US$68.81 billion in 2023. Among them, the North American market is the largest (accounting for about 43%), followed by Europe; Asia-Pacific (especially China) has the fastest growth rate. The Chinese market has increased from about RMB 66.25 billion in 2014 to RMB 150 billion in 2023, with an average annual high growth rate.

- **Product innovation: **Children’s educational toys are developing towards STEM/programming and intelligence: new products such as robots, programming learning machines, VR/AR interactive toys, etc. have emerged, enhancing the educational attributes of games. Technology integration and improved playability are new trends.

- **Consumption upgrade: **Parents are paying more and more attention to the educational value and safety quality of toys. Online channels (Tmall, JD.com, Pinduoduo, etc.) have become the main battlefield for toy sales, and new models such as live streaming have enabled products to reach a wider range of consumers. At the same time, high-end brands (such as Lego, Finnish Spielware educational toys, etc.) occupy the upper market due to their excellent quality and innovative design. Overall, the global competition for educational toys is fierce, international brands dominate with brand power and technology, and domestic brands step up R&D and marketing innovation to compete for the market.

Baby travel products

- **Car safety seats: **In 2024, the global market size of infant car safety seats is about 37.18 billion yuan, and it is expected to reach 52.95 billion yuan in 2030 (CAGR ≈ 6.1% from 2024 to 2030). Europe has the largest market share (about 28%), and China accounts for 22%. With the tightening of safety regulations and the improvement of parents’ safety awareness, the demand for high-quality seats has increased significantly. The main brands include international brands such as Britax (Britax), Cybex (Cybex) (Germany), and Maxi-Cosi (Maxi-Cosi) (Netherlands), as well as domestic brands such as Babyfirst, Savile (Owl), and Goodbaby. In the future, seats will integrate more intelligent technologies (such as biometric monitoring sensors, collision airbags, etc.) and easy-to-use designs to enhance competitiveness.

- **Baby strollers: **In 2023, the global baby stroller (Stroller/Pram) market size is about 1.15 billion US dollars. Rapid urbanization and the rising proportion of dual-income families have made compact, foldable, and lightweight strollers popular. The use of environmentally friendly materials has also become a trend, and some brands have launched eco-friendly models such as recyclable plastics and natural fabrics. Major brands include China’s Goodbaby (GB), CyBEX (CyBEX, a subsidiary of Goodbaby Group), the Netherlands’ Bugaboo, and Norway’s Stokke. These brands have taken the lead in the market with high-end design and technology, and have also accelerated the development of global baby stroller products towards “automotive-grade safety + fashion innovation”. In terms of consumer preferences, they pursue products with simple design, safety and reliability, and easy operation, while paying more and more attention to after-sales and product safety certification.

**Summary: **Between 2014 and 2024, the global maternal and infant market continued to evolve driven by fluctuations in the birth population, emerging demands, and innovation. Overall, the decline in the birth population has slowed down the overall market growth rate, but consumption upgrades and product innovations (such as organic environmental protection, smart technology, etc.) have brought new growth points to the maternal and infant industry. Each market segment shows a trend of upgrading from low price to high-end, and from satisfying basic needs to pursuing quality and personalization. The above data and analysis refer to industry reports and authoritative statistical sources.